AML Solution for Digital Assets

Enhancing AML compliance and detection of trading entities for cryptocurrency service providers and regulators

Please use Chrome or FireFox to visit

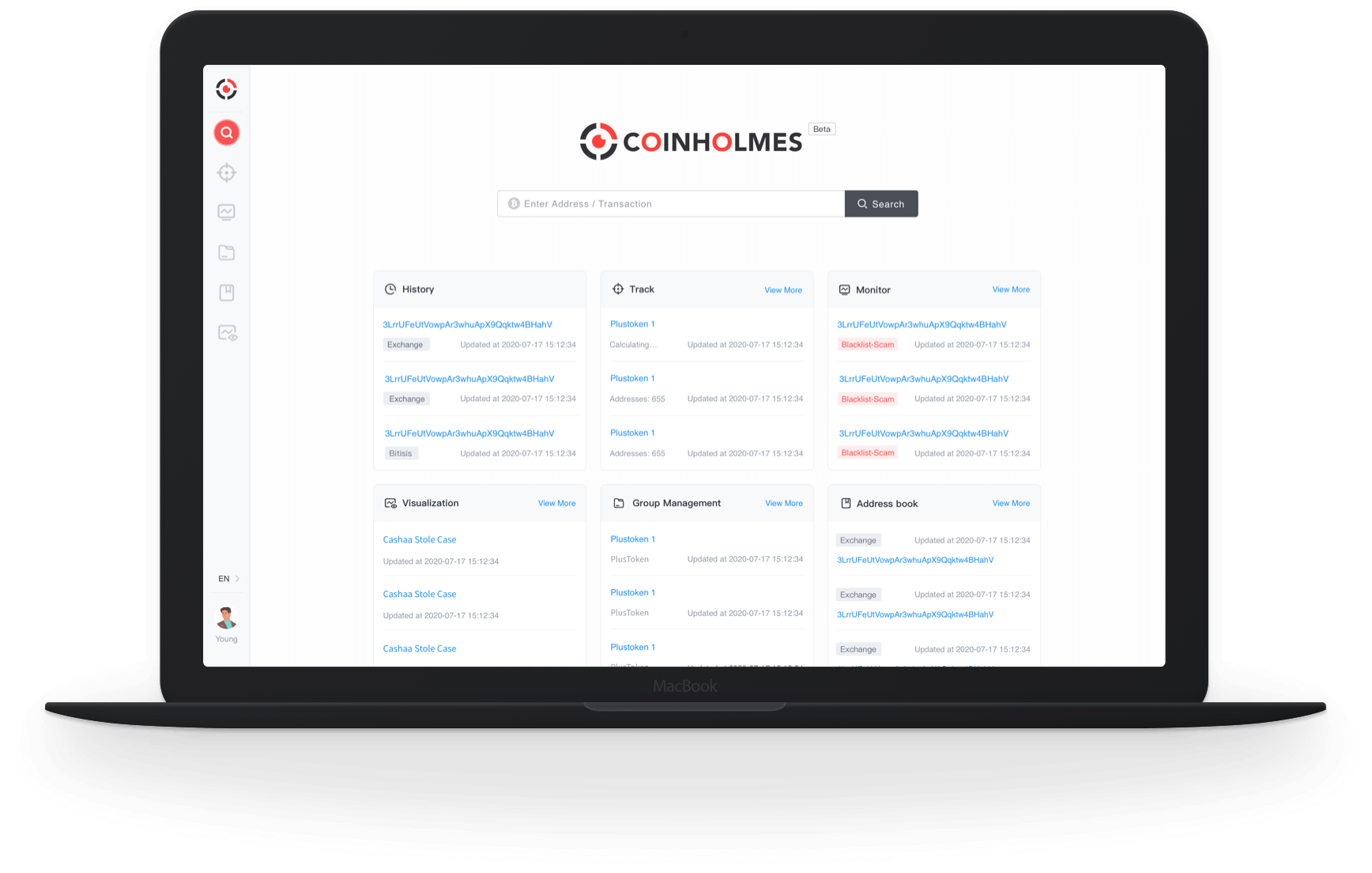

Our Services

We provide blockchain data, analytic services and anti-money laundering (AML) solutions for exchanges, crypto wallets, and other organizations operating in the cryptocurrency business, financial institutions and government agencies, helping our clients to prevent financial crime risks and further enhance AML compliance.

Criminal Investigation Agency

Through CoinHolmes, understanding real-world entitie behind each transaction, and mapping the flow of funds into a visual view, making it easier to counter money laundering, fraud, dark web trading and other digital asset crimes.

Crypto Exchanges & Wallets

Through CoinHolmes, monitoring and identifying abnormal transactions originating from dark web markets, sanctioned addresses and fraudulent addresses in real time, preventing the inflow of illicit assets and securing customers’ withdrawals.

Financial Institutions

Through CoinHolmes, be able to find out the user increment and coin deposits and withdrawals for major exchanges, understanding global asset distribution, mitigating potential risks, and monitoring client asset movements.

Past experience of assisting clients with anti-money laundering for asset tracking

Understanding case information

analyzing fund flow

matching the subjects of funds

targeting the suspects

issuing forensic reports

Cryptocurrency AML Research

A global study on cryptocurrency markets, regulations and developments

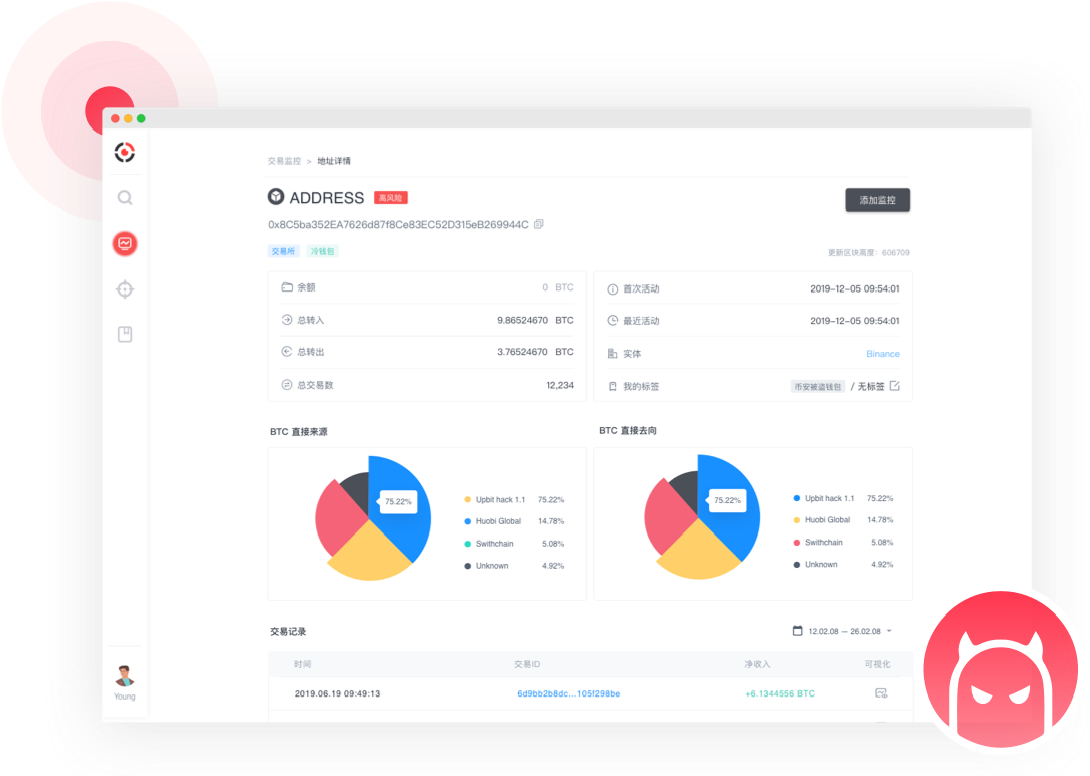

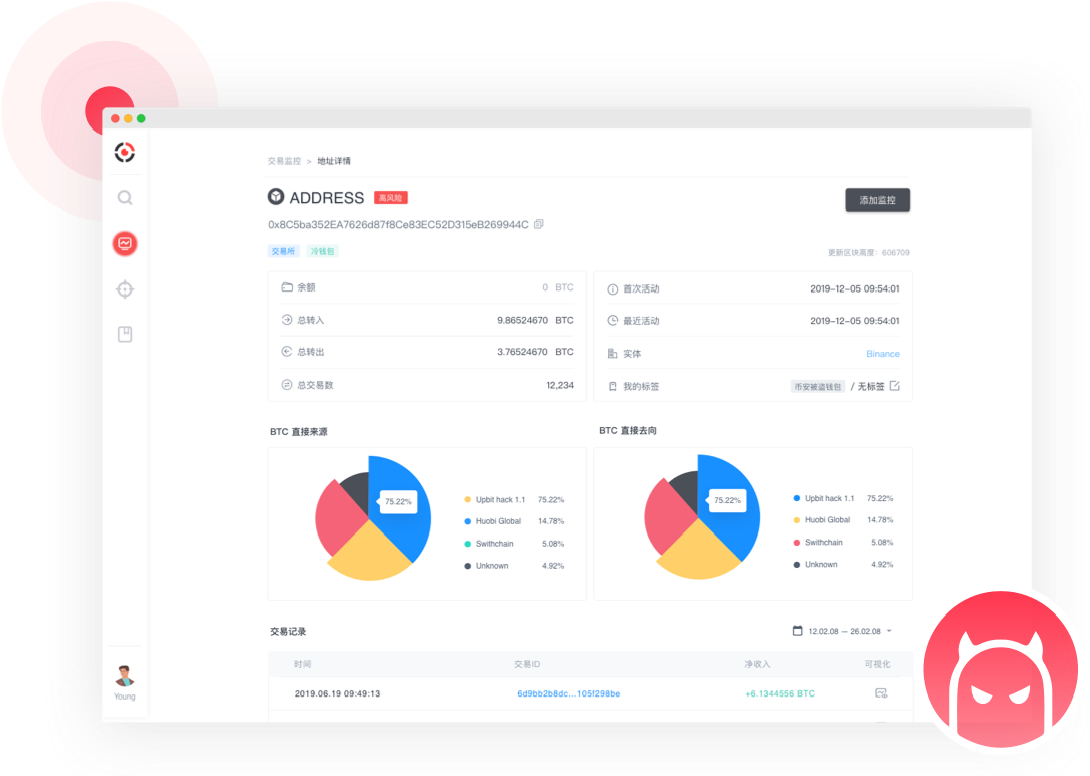

Understanding your transactions and connecting cryptocurrency transactions to real-life entities, to effectively identify financial risks and combat criminal activity on the blockchain.

KYT

Use KYT to understand the real-world entity behind every trade and transaction. KYT can detect many risky trading patterns. It covers exchange users’ deposit and withdrawal transactions, exchange fund pooling transactions, and other unusual trading behaviors such as high-risk dark web trading, fraudulent addresses, sanctioned addresses, etc.

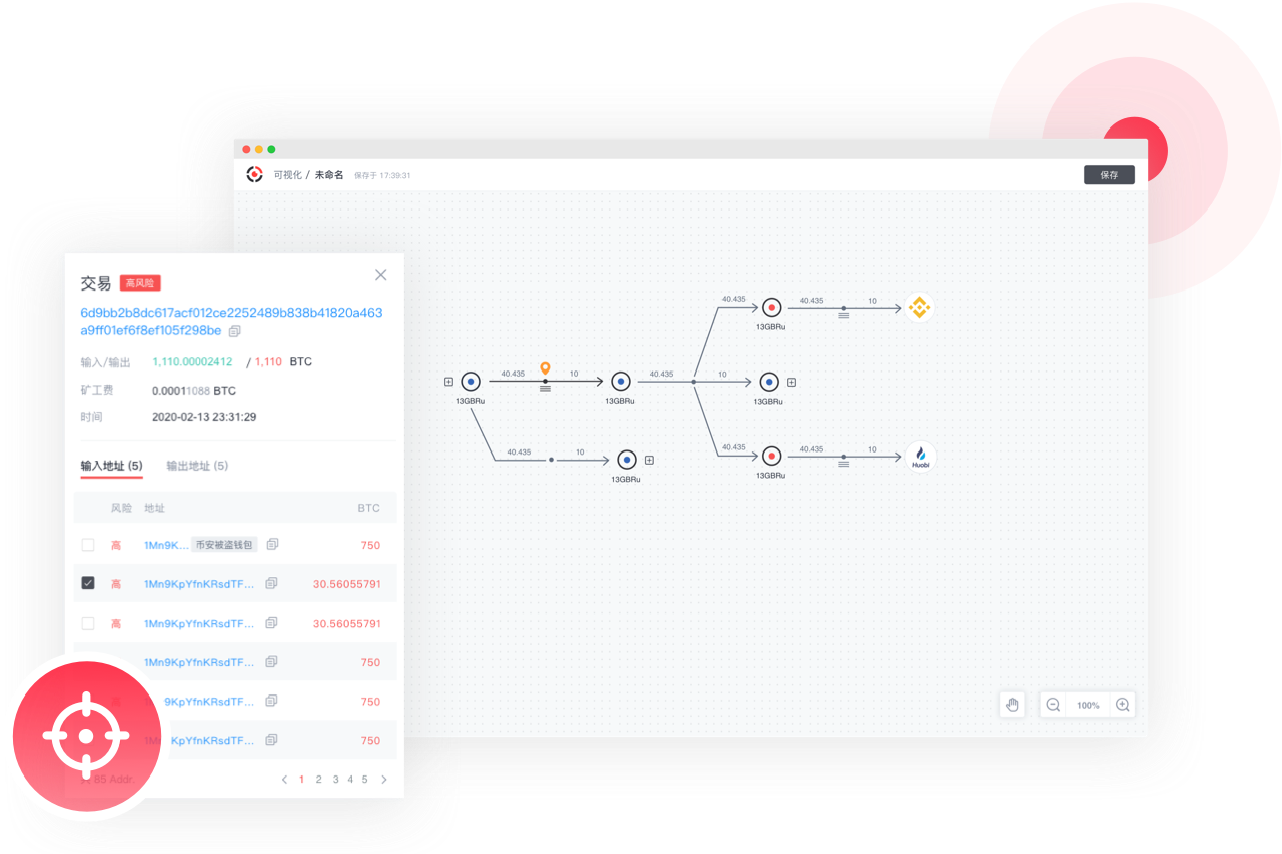

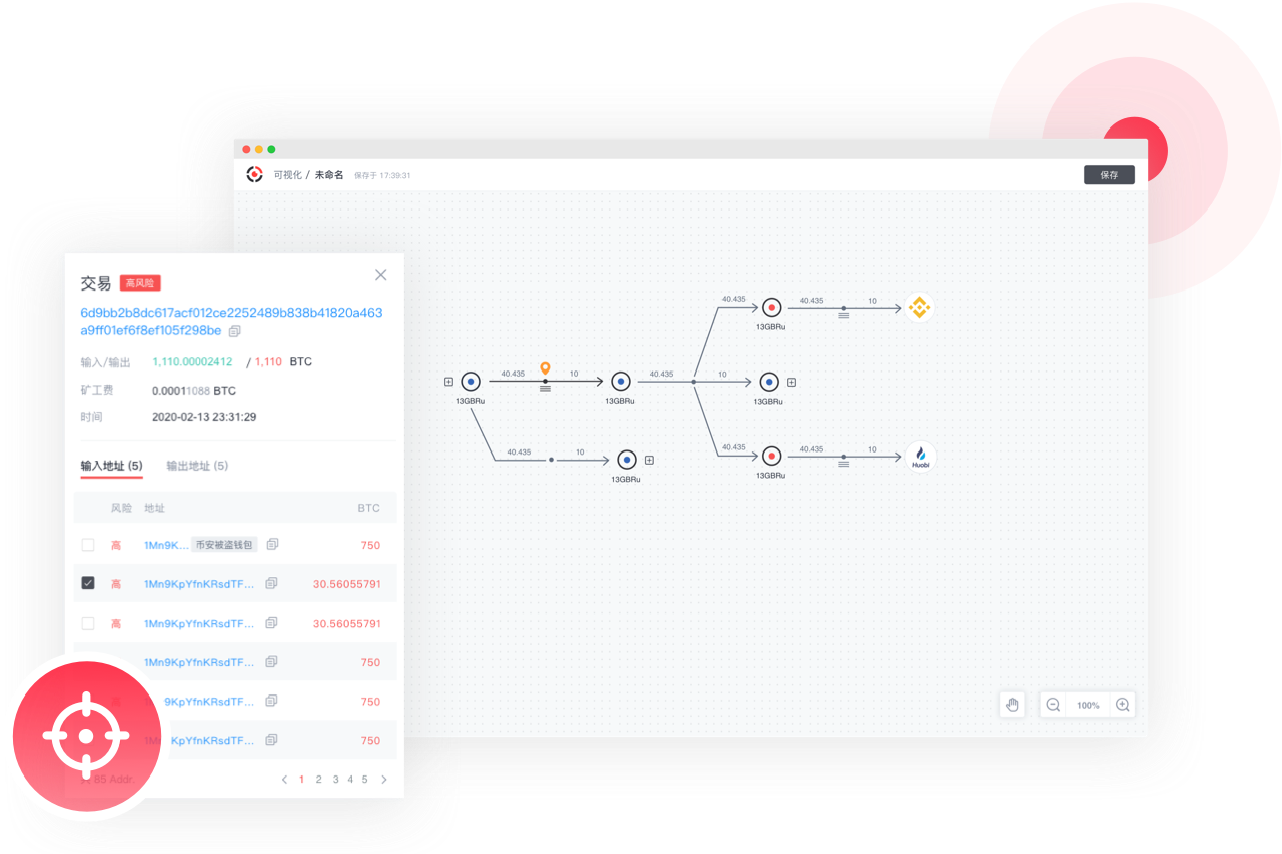

Assets Tracking

Using powerful and convenient asset tracking tools that visually map an unlimited number of layers of money flows and can be linked to real-world entities in the view, so as to achieve more in-depth investigations.

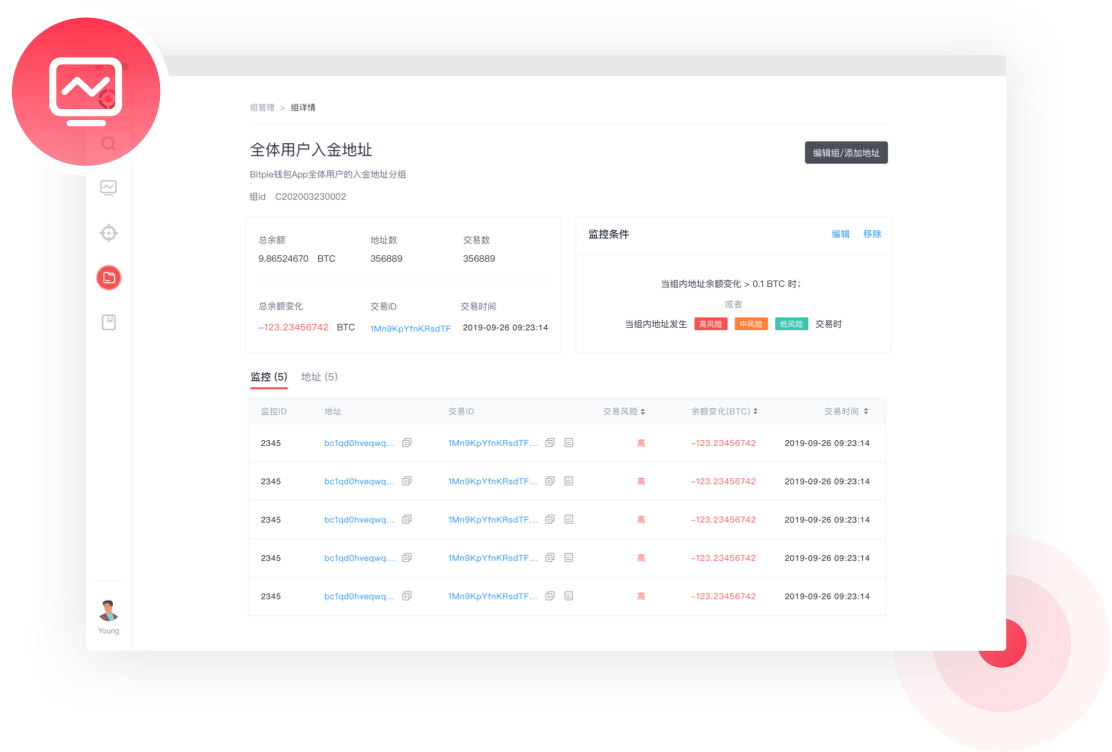

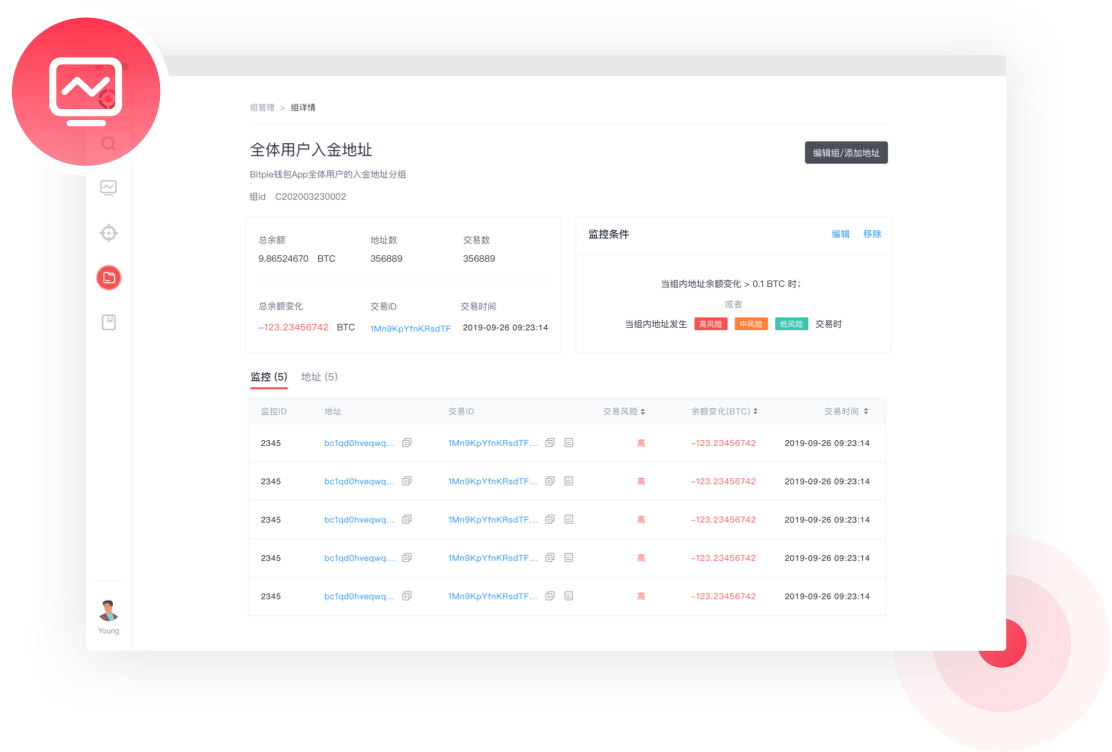

Real-time Alert

By using CoinHolmes, you can monitor changes in address balances, identifying and alerting on high-risk asset inflows and freezing deposits of dark web assets, fraudulent proceeds and stolen assets, preventing customer withdrawals to blacklisted addresses and providing risk alerts when customers are confirming their withdrawals.